Sole Trader vs Limited Company UK Guide

Sole Trader vs Limited Company UK Guide – Deciding how to set up your business is one of the very first hurdles every new entrepreneur in the UK faces. The path you choose—going it alone as a sole trader or setting up a limited company—has a massive impact on your personal liability, how much tax you pay, and the amount of admin on your plate. It even shapes how clients and banks see you.

For many freelancers and small business owners, starting out as a sole trader is the simplest and quickest route. There’s hardly any paperwork and the setup costs are low. But that simplicity comes with a huge catch: unlimited liability. This means there’s no legal separation between you and your business, putting your personal assets on the line if things go wrong.

A limited company, on the other hand, creates a solid legal wall between you and the business. This structure gives you more credibility and is often a must-have if you want to attract investment or win bigger contracts. While it offers vital protection for your personal finances, it does mean more paperwork and formal reporting.

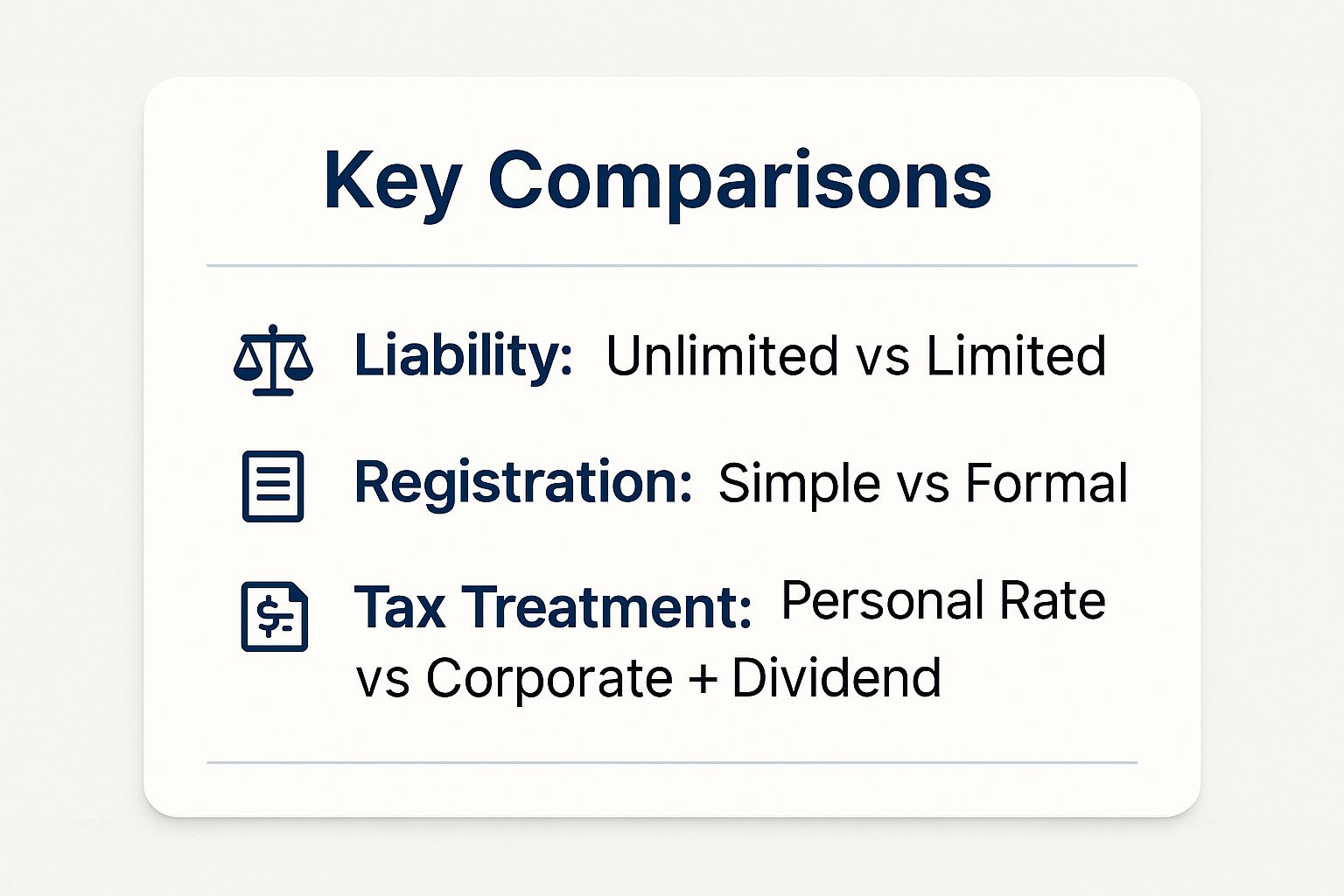

This infographic neatly sums up the main differences in liability, registration, and tax.

As you can see, the limited company acts as a protective shield for your personal assets, which is the single biggest advantage over the sole trader model. To get a better handle on what this means for you, have a look at our detailed guide on choosing the right business structure in the UK.

Key Differences: Sole Trader vs Limited Company

To make the choice clearer, here’s a straightforward comparison table breaking down the most critical differences between the two structures.

| Aspect | Sole Trader | Limited Company |

|---|---|---|

| Personal Liability | Unlimited – your personal assets are at risk. | Limited – your personal assets are protected. |

| Legal Status | You and the business are a single legal entity. | The business is a separate legal entity. |

| Tax Treatment | Profits taxed via Income Tax and National Insurance. | Profits taxed via Corporation Tax; income via salary and dividends. |

| Administration | Simple – register with HMRC and file Self Assessment. | More complex – must file accounts with Companies House. |

| Public Record | Your business details are kept private. | Director and company information is publicly available online. |

Ultimately, the choice comes down to what you value most right now. If simplicity and minimal fuss are your priorities, being a sole trader is a great starting point. If you’re thinking bigger, want to protect your assets, and are prepared for a bit more admin, a limited company is probably the smarter move.

How Legal Liability Impacts Your Personal Assets

When you’re weighing up whether to be a sole trader or a limited company, there’s one factor that stands above all others: legal liability. This isn’t just boring legal jargon; it’s the very thing that determines whether your home and personal savings are at risk if your business runs into trouble.

The business structure you pick either draws a clear line in the sand or completely erases it. Understanding this is absolutely fundamental.

As a sole trader, the law doesn’t see you and your business as two separate things. You are the business. This means you’re personally on the hook for every single debt and obligation it has. This is known as unlimited liability, and its consequences can be life-changing.

The Reality of Unlimited Liability for Sole Traders

Unlimited liability is exactly what it sounds like. If your business can’t pay its bills, your creditors can come after your personal assets to get their money back. We’re talking about your savings account, your car, and even your family home. The boundary between your business life and your personal life simply disappears.

Practical Example: The Freelance Graphic Designer

Imagine you’re a freelance graphic designer operating as a sole trader. You’ve just finished a major branding project, but the client is unhappy. They claim your work caused their product launch to fail and are suing you for damages of £30,000.

Because you’re a sole trader, they aren’t suing the business—they’re suing you. If the court agrees with them and your professional indemnity insurance doesn’t cover the full claim, you’ll have to find that £30,000 from your own pocket. That could mean emptying your life savings or even being forced to sell your car.

The Protective Shield of a Limited Company

A limited company, on the other hand, offers a powerful protective shield. When you register with Companies House, you create a completely separate legal entity. Your business can sign contracts, own property, and take on debt in its own name, entirely separate from you.

This is the killer feature of a limited company: it creates a firewall between your business finances and your personal finances. Your liability is limited to the money you’ve invested in the company, usually the value of your shares.

This legal separation is why so many entrepreneurs choose to incorporate. While around 55% of small UK businesses start as sole traders for simplicity, many make the switch to a limited company as they grow, purely to protect themselves from this personal risk.

Practical Example: The Small Retail Business

Now, let’s say you’re the director of a small limited company running a retail shop. Times get tough, and the business racks up £20,000 in debt with suppliers that it can no longer pay. Sadly, the shop has to close down.

Because the contracts were with the company, the suppliers can only make a claim against the company’s assets. Your personal bank accounts, your home, and your car are completely safe. Unless you’ve given a personal guarantee for a loan, you are not responsible for the company’s debts. This clear separation is one of the most vital parts of running a limited company in the UK.

Navigating Your Tax and National Insurance Obligations

For most people weighing up their options, the sole trader vs limited company debate often comes down to one simple question: which route leaves more money in my pocket? The answer isn’t always straightforward because it hinges on the fundamental tax differences between the two structures.

When you’re a sole trader, the law doesn’t see you and your business as separate. This means your finances aren’t taxed separately either. All your business profits are simply treated as your personal income.

You’ll pay Income Tax and National Insurance Contributions (NICs) on everything you earn. While this makes for simpler accounting, it can become less tax-efficient as your profits start to climb.

How Sole Traders Are Taxed

As a sole trader, your tax is handled through your annual Self Assessment return. On top of Income Tax, you’ll also be responsible for two classes of National Insurance.

- Class 2 NICs: A small, flat weekly rate you pay if your profits are above a certain threshold.

- Class 4 NICs: A percentage of your profits that fall between the lower and upper limits.

Practical Example: The Sole Trader Consultant

Imagine an IT consultant operating as a sole trader who makes a profit of £65,000. After deducting the Personal Allowance (£12,570), the remaining £52,430 is subject to Income Tax and National Insurance. They would pay 20% on the portion up to £50,270 and 40% on the amount above it, plus Class 4 National Insurance on the entire profit. A significant chunk goes straight to HMRC.

The key thing to remember here is that every single pound of profit is taxed as your personal earnings, whether you actually take it out for yourself or leave it in the business account.

The Limited Company Tax Structure

A limited company introduces a bit more complexity, but with it comes the potential for much greater tax efficiency. Because the company is its own legal entity, its profits are taxed separately through Corporation Tax.

Once the company has settled its Corporation Tax bill, you—as the director and shareholder—get to decide how to draw money from the remaining funds. This is where the smart tax planning begins. The classic approach is to take a small, tax-efficient salary topped up with dividends.

One of the biggest differences is clear when you look at the numbers for the 2025/26 tax year. Sole traders face progressive income tax bands, while limited companies pay Corporation Tax on their profits, set between 19% and 25%. This rate is often much lower than the higher personal tax rates sole traders can find themselves paying.

Practical Example: The Limited Company Director

Let’s take our IT consultant again, but this time they’re the director of a limited company that also makes £65,000 in profit.

- First, the company pays Corporation Tax (e.g., 19%) on the £65,000 profit.

- The director then pays themselves a small salary, say £12,570, which is tax-free and incurs no National Insurance.

- The remaining post-tax profit can be taken as dividends. The director gets a dividend allowance, and dividends are taxed at lower rates than income.

This salary-and-dividend mix almost always results in a lower overall tax bill compared to a sole trader taking home the same £65,000 profit. To see exactly how the numbers would work for you, it’s worth plugging your figures into a sole trader vs limited company tax calculator.

Key Insight: The tipping point where a limited company usually becomes more tax-efficient is when your profits start pushing you firmly into the higher-rate Income Tax band (currently over £50,270). At that level, the lower combined rates of Corporation Tax and dividend tax typically beat the higher rates of Income Tax and National Insurance.

Ultimately, the sole trader setup wins on simplicity, but the limited company offers financial flexibility. It puts you in control of how and when you take your profits, providing powerful tools for tax planning that can lead to big savings as your business grows.

Comparing Administrative Burdens and Running Costs

Beyond the big questions of tax and liability, the day-to-day reality of running a business often comes down to two things: paperwork and costs. It’s a classic trade-off. While a limited company can offer serious advantages as you grow, that protection and tax flexibility comes at the price of more admin and higher running costs.

For many people just starting out, the sheer simplicity of the sole trader route is its biggest selling point.

The Sole Trader Experience: Light on Admin, Low on Cost

If you set up as a sole trader, the administrative load is refreshingly light. Your main job is to tell HMRC you’re self-employed, and from then on, your key annual task is to file a Self Assessment tax return. That’s it. There are no registration fees with HMRC, so you can get started with virtually zero financial outlay.

Practical Example: The Local Plumber

A plumber starting his own business registers as a sole trader. Each year, his only legal filing requirement is to submit his Self Assessment by January 31st. He uses a simple spreadsheet to track his income from jobs and his expenses like fuel, tools, and materials. The process takes him a couple of evenings, and he doesn’t need to pay an accountant.

This low-overhead model is perfect for testing a business idea without having to commit significant time or money to compliance.

- Registration: A one-time, free registration with HMRC gets you your Unique Taxpayer Reference (UTR) number.

- Annual Filing: You file one Self Assessment tax return each year, with the online deadline on the 31st of January.

- Record Keeping: You just need to keep organised records of your sales and expenses so you can work out your profit for your tax return.

- Costs: There are no mandatory fees. Any costs, like accounting software or hiring an accountant, are entirely your choice.

The Limited Company Director’s Duties: A Step Up in Responsibility

Switching to a limited company instantly adds a layer of formal responsibility. As a company director, you have legal duties not just to HMRC but also to Companies House. Your business is now its own legal person, and you’re officially in charge of keeping its records straight and filing the right documents on time.

Forget just one tax return. You’re now responsible for filing detailed company accounts, a separate company tax return, and an annual confirmation statement. Miss a deadline, and you can expect hefty, automatic penalties.

This is a crucial difference to grasp. A sole trader is just managing their own personal tax. A limited company director has a legal, fiduciary duty to manage the company’s compliance. That formal responsibility is a massive part of the equation.

Practical Example: The Web Design Agency

A freelance web developer incorporates her business, “Web Creations Ltd.” Her annual compliance checklist is now much longer:

- Company Accounts: File with Companies House within 9 months of the company’s year-end.

- Company Tax Return: File with HMRC within 12 months.

- Confirmation Statement: File with Companies House once a year to confirm the company’s details are correct.

- PAYE: Run a payroll to pay herself a salary.

- Self Assessment: Still file a personal tax return for her salary and dividends.

Faced with this, she hires an accountant for £1,200 per year to manage it all, a direct cost that the sole trader plumber did not have. While the company might save her tax, it introduces a significant and unavoidable operational cost.

This is the central dilemma you’ll face: the beautiful simplicity of being a sole trader versus the potential tax efficiency (and added complexity) of a limited company.

How Your Structure Affects Credibility and Growth

The choice between being a sole trader or a limited company goes way beyond just tax and liability. The structure you pick sends a powerful signal to clients, suppliers, and investors, directly shaping how they see your business. This perception can either open doors for you or keep them firmly shut.

For freelancers and new service businesses just starting out, the sole trader route is often a perfect fit. But as your ambitions grow, this simplicity can start to look like a lack of scale. Perception really does matter, and a limited company tends to project an image of greater substance and permanence.

Building Professional Credibility with ‘Ltd’

Those three little letters, ‘Ltd’, do more than just signal a legal status; they’re a badge of credibility. For larger corporate clients, working with a registered company provides a real sense of security. They know they’re dealing with a formal entity registered at Companies House, which often makes them more willing to sign off on substantial contracts.

Practical Example: The Ambitious Marketing Consultant

A freelance marketing consultant, working as a sole trader, does fantastic work for small local businesses. She spots an opportunity to pitch for a large, six-figure contract with a national retail chain. The problem? The chain’s procurement policy demands that all its suppliers be incorporated limited companies for liability and compliance reasons.

By registering as “Marketing Solutions Ltd”, she not only ticks their box but also appears more professional and established. That simple structural change is the key that unlocks the door to competing for much bigger projects.

Attracting Investment and Fuelling Growth

If your long-term plan involves seeking outside investment, the choice is pretty much made for you. A limited company structure isn’t just a good idea; it’s practically essential. Investors need a clear, legally sound way to put money into a business in exchange for ownership, and that means issuing shares.

A sole trader simply can’t issue shares because there’s no legal separation between the owner and the business. Investors demand the clean, defined framework of a limited company to protect their investment and formalise their stake.

Practical Example: The Tech Startup

Two founders create a new software app. They need £100,000 to hire developers and launch their product. They approach an angel investor, who agrees to provide the funding in exchange for 20% of the business. As a limited company, they can legally issue new shares to the investor, formalising the ownership agreement. As sole traders, this entire transaction would be impossible.

- Share Capital: A limited company can easily create and issue new shares to bring in capital from angel investors or venture capitalists.

- Clear Governance: The roles of directors and shareholders are legally defined, providing the clear governance structure that investors expect to see.

- Scalability: The limited company model is built for growth, making it the only realistic option for startups with ambitions to scale up quickly.

Ultimately, while the sole trader model offers brilliant simplicity for getting started, the limited company structure is the foundation upon which bigger, more ambitious businesses are built.

So, Which Business Structure is Right for You?

Choosing between being a sole trader or a limited company isn’t about picking the “best” option—it’s about what’s right for you, right now. All the talk about tax, liability, and admin really boils down to one simple question: what does this mean for my business today? Let’s turn the theory into some real-world advice.

By looking at a few common scenarios, you can quickly see which path makes the most sense for your goals, how much risk you’re comfortable with, and where you are in your business journey. And remember, the decision you make now isn’t set in stone, but getting it right from the start saves a lot of hassle down the line.

You’re a New Freelancer or Just Starting Out

If you’re kicking off your career as a freelance writer, a part-time developer, or a newly qualified electrician, the sole trader route is almost always the most sensible first step. Your energy should be focused on landing those first few clients and getting money in the door, not getting bogged down in complex paperwork.

Practical Example: The Freelance Copywriter

A copywriter starts taking on small projects for local businesses. In her first year, she expects to make around £15,000 in profit. For her, the extra admin and potential accountancy fees (£1,000+) of a limited company would wipe out any small tax advantage. As a sole trader, she can put all her effort into building a portfolio and client list without distraction.

You’re Building a Business to Scale

If your plan is to build a tech product, a retail brand, or any business designed for rapid growth and outside investment, a limited company is non-negotiable from day one. Your vision goes beyond just making a living—you’re creating an asset that needs a formal legal framework to grow.

Investors, for instance, will only deal with a limited company. Why? Because it allows them to buy shares, which is the clean, legal way to inject cash in return for equity. It also gives you the professional credibility needed to win bigger contracts and secure business loans.

Practical Example: The E-commerce Brand

A founder is creating a new sustainable clothing brand. Her plan is to raise £50,000 in seed funding within the first year to fund the initial stock order and marketing launch. By setting up a limited company from the start, she creates a separate legal entity that can own the brand’s intellectual property, sign contracts with manufacturers, and—most importantly—issue shares to the investors she needs to attract.

You’re a Successful Sole Trader Ready for the Next Step

What happens when you’re already an established sole trader and your profits are climbing? The trick is to watch for a few key signals that it might be time to incorporate.

The biggest trigger is usually your income. Once your profits start consistently pushing you into the higher-rate tax band (currently over £50,270), it’s time to do the maths. At this point, the tax efficiency of a limited company—paying yourself a small salary and taking the rest in dividends—often means you keep more of your hard-earned money, even after paying for an accountant.

Another major factor is risk. As your business gets bigger, so do its potential liabilities. Forming a limited company puts a protective wall between your business debts and your personal assets, like your home.

Got Questions? Let’s Clear a Few Things Up

Even after weighing up the pros and cons, you might still have a few specific questions buzzing around. That’s perfectly normal. Here are the answers to some of the most common queries we hear from entrepreneurs trying to make this exact decision.

Can I Switch From a Sole Trader to a Limited Company Later?

Yes, absolutely. This is not only possible but incredibly common. Many founders start out as sole traders to keep things simple and then make the switch once profits start climbing or the risks get bigger.

The process is fairly straightforward: you register a new limited company with Companies House and then transfer the assets and goodwill from your old sole trader setup to the new company. It’s a good idea to chat with an accountant to make sure this transition is handled smoothly, especially when it comes to valuing your assets correctly and tidying up your final sole trader tax return.

Does a Limited Company Need a Separate Business Bank Account?

Yes, this one is non-negotiable. It’s a legal requirement. Because your limited company is its own legal entity—separate from you—its money must be kept completely separate from your personal finances. All business income and expenses have to go through a dedicated business bank account.

This is a major difference from being a sole trader, where a separate account is just good practice (and highly recommended!) but not legally mandatory.

Important Reminder: As a company director, you have a legal duty to keep accurate financial records. Mixing business and personal cash in the same account is a breach of that duty and will create a real headache for your accountant and HMRC.

Which Structure Is Better for Getting a Mortgage?

This is a tricky one, where perception and paperwork are everything. A few years ago, mortgage lenders definitely favoured the steady payslip of an employee, which made life harder for both sole traders and company directors.

Thankfully, things have moved on. Most lenders are now comfortable with both business structures, but they’ll look at your income in different ways:

- For a Sole Trader: They’ll typically want to see your net profit, usually averaged over the last two or three years, proven by your Self Assessment tax returns.

- For a Limited Company Director: They’ll usually look at your director’s salary combined with any dividends you’ve taken. They will want to see your company accounts to confirm the business is profitable enough to support those drawings.

Ultimately, one isn’t inherently “better” than the other. The key for both is having at least two years of clean, professionally prepared accounts to prove your income is stable.