Sole Trader Tax Deductions

UK Sole Trader Tax Deductions Explained – As a sole trader, your tax bill is calculated on your profit, not your total turnover. This simple fact is the most powerful tool you have.

Why? Because it means legally reducing your profit by claiming every possible sole trader tax deduction is the single best way to keep more of your hard-earned cash. These deductions, which HMRC calls ‘allowable expenses’, are simply the essential costs you incur to run your business.

How Sole Trader Tax Deductions Actually Work

Let’s cut through the jargon. A tax deduction is just a business cost that you’re allowed to subtract from your total income before HMRC works out how much tax you owe.

The principle is pretty straightforward: you only pay tax on the money you actually make after your business running costs are covered. Getting your head around this is the first step to managing your finances like a pro.

Let’s use an example. Imagine you’re a freelance graphic designer and you invoice clients for a total of £50,000 in one year. But to earn that money, you had to spend £10,000 on essentials.

This isn’t just one big cost; it’s a collection of smaller ones that add up:

- Software Subscriptions: £2,000 for Adobe Creative Cloud.

- New Equipment: £1,500 for a powerful new laptop to handle big design files.

- Marketing Costs: £3,000 on social media ads to find new clients.

- Office & Admin: £3,500 on your home office bills, stationery, and professional insurance.

Instead of paying income tax on the full £50,000, you deduct that £10,000 in allowable expenses. Suddenly, your taxable profit is only £40,000. This directly lowers your tax and National Insurance bill, putting thousands of pounds back where it belongs – in your pocket.

Understanding these basics of running a sole trader business is the foundation for optimising your tax position.

The Impact On Your Tax Bill

The power of deductions becomes even clearer with bigger numbers. Say a consultant earns £80,000 and has £20,000 in allowable expenses. They’d only pay tax on the remaining £60,000—a massive saving.

The UK tax system is set up to help small businesses and freelancers, especially those operating on tight margins. By keeping meticulous records, you can make sure you take full advantage of every single deduction available to you.

The key takeaway is simple: Every legitimate pound you spend on your business is a pound you don’t pay tax on. Tracking these costs isn’t just good bookkeeping; it’s a strategic financial move.

This applies to all sole traders, whether you’re a plumber buying tools, a copywriter paying for web hosting, or a business coach covering travel costs. In the next sections, we’ll break down exactly which expenses you can claim so you never miss a chance to lower your tax bill.

The Most Common Expenses You Can Claim

Trying to pin down every possible tax deduction you can make as a sole trader can feel a bit like chasing shadows. The good news? A huge chunk of your everyday business costs are likely claimable. This section isn’t just a boring list; it’s a practical guide to help you confidently identify and claim the expenses you’re entitled to.

We’ll walk through the main categories of “allowable expenses,” from the cost of running an office and travelling for work to marketing your business and paying for professional advice. The goal is simple: to make sure you spot every opportunity to lower your taxable profit and keep more of your hard-earned money.

To give you a clearer picture, let’s break down the most common allowable expenses into a handy table with some real-world examples.

Common Allowable Expenses and Practical Examples

This table organises the typical tax-deductible expenses for sole traders, showing what you can claim and what to watch out for in each category.

| Expense Category | Examples of What You Can Claim | Important Notes |

|---|---|---|

| Office & Premises | Rent for your office/workshop, business rates, utility bills (gas, electric, water), stationery (paper, ink), postage. | If you work from home, you can only claim a proportion of these costs. We’ll get to that next! |

| Working from Home | A proportion of your mortgage interest/rent, council tax, home insurance, and utility bills. Also phone and broadband costs. | You can use HMRC’s simplified flat rate or calculate the actual business percentage. Be logical and fair with your calculations. |

| Travel & Vehicle | Train/bus fares, flights, taxis for business trips. Hotel stays and reasonable meal costs for overnight work travel. Parking fees. | Your daily commute to a permanent workplace doesn’t count. For your car, you can claim a 45p per mile allowance or a proportion of actual running costs. |

| Staff & Subcontractors | Employee salaries and bonuses, employer’s National Insurance contributions, workplace pension payments, and fees paid to freelancers. | You must keep detailed payroll records and all subcontractor invoices. Misclassifying an employee can lead to serious trouble with HMRC. |

| Marketing & Fees | Online advertising (Google, Facebook), website hosting and design costs, professional body memberships, fees for your accountant. | These costs must be for promoting your business or getting essential professional advice. |

| Financial & Insurance | Business bank account fees, interest on business loans, professional indemnity or public liability insurance premiums. | Personal loan interest or insurance policies that aren’t for the business are not allowable. |

This table gives a great overview, but let’s dive into some of the categories that often cause the most confusion, like working from home or vehicle costs, to make sure you get it right.

A Closer Look at Working From Home

This is one of the most common and valuable sole trader tax deductions out there. If your home is your main place of business, you can claim a slice of your household running costs.

You’ve got two options here: use HMRC’s simplified flat rate (which we’ll compare later on) or do the maths on your actual costs. To work out the actual costs, you need to figure out the business proportion of your total bills for things like:

- Council Tax

- Mortgage interest or rent

- Electricity and gas

- Home insurance

- Broadband and phone line usage

How This Works in Practice

Let’s say your home has five rooms, and you use one exclusively as your office. If your total annual electricity bill is £1,200, a logical approach would be to claim one-fifth of that cost. That’s £240 you can deduct as a business expense. You’d apply a similar, fair calculation to your other household bills.

Understanding Travel and Vehicle Costs

The key rule here is that costs for travelling specifically for business are fully deductible. It’s so important to remember that your regular commute from home to a permanent workplace is not considered business travel.

Practical Example: A self-employed IT contractor travels by train from their home office in Manchester to a client’s site in London for a two-day project. The £150 return train ticket, £120 for a one-night hotel stay, and £25 for an evening meal are all allowable expenses.

Allowable travel expenses include things like train tickets to meet a client, taxi fares to a conference, or hotel bills for an overnight work trip. For your own vehicle, you can either claim a flat mileage allowance (45p per mile for the first 10,000 miles) or tally up the actual running costs. If you go for the second option, you can claim a proportion of your fuel, insurance, servicing, and MOT costs based on your business mileage.

Don’t Forget Marketing and Professional Fees

Getting the word out about your business and paying for expert advice are fundamental to growth, and thankfully, HMRC agrees. These costs are tax-deductible, which helps take the sting out of investing in promotion.

Practical Example: A freelance copywriter pays £120 for a year’s web hosting, spends £300 on Google Ads to attract new clients, and pays their accountant £400 to prepare their annual tax return. All £820 of these costs are fully tax-deductible.

You can typically claim for:

- Advertising: Costs for online ads, newspaper spots, or directory listings.

- Website Costs: Expenses like domain registration, hosting, or paying a developer.

- Professional Subscriptions: Your annual fee for a relevant trade body or organisation.

- Accountancy and Legal Fees: The bill from your accountant for sorting your business taxes or a solicitor for legal advice.

By methodically tracking these common expenses, you can build a complete picture of your sole trader tax deductions. It’s not about finding loopholes; it’s about making sure you don’t pay a penny more in tax than you legally need to.

Claiming for Large Business Purchases and Assets

While your day-to-day costs are fairly straightforward allowable expenses, what happens when you buy big-ticket items? A builder’s van, a photographer’s high-end camera gear, or a powerful new computer for a developer aren’t treated in quite the same way.

These are considered capital assets because they’re investments that will benefit your business for a long time, not just for a single project.

Instead of writing off the full cost in one go, you get tax relief through a system called capital allowances. Think of it like this: an everyday expense is like buying a coffee to get you through the afternoon. A capital asset is like buying the entire coffee machine. You don’t “use up” the machine in one day, so you claim its value over its working life.

This process ensures your sole trader tax deductions accurately reflect how these major assets lose value over time, giving you a structured way to get tax relief on those significant investments.

The Power of the Annual Investment Allowance

Luckily, for most sole traders, there’s a special rule that simplifies all this: the Annual Investment Allowance (AIA). The AIA lets you deduct 100% of the cost of most qualifying assets from your profits in the year you buy them, up to a very generous limit (currently £1 million).

This means that even though an item is technically a capital asset, the AIA often allows you to treat it like a regular expense for tax purposes. It’s a huge helping hand for small businesses, making it easier to invest in the equipment needed to grow.

In essence, the AIA lets you fast-forward your tax relief. Instead of spreading the deduction over several years, you get the full benefit immediately. This can make a massive difference to your tax bill for that year.

Let’s see how this works with a practical example.

Calculating Capital Allowances in Action

Imagine you’re a freelance videographer and you buy a new professional-grade camera and lens kit for £5,000. Because this gear will last you for years, it’s a capital asset.

Here’s how you’d claim for it using the AIA:

- Identify the Asset: Your new camera kit is a piece of qualifying ‘plant and machinery’.

- Check the AIA Limit: The £5,000 cost is comfortably within the £1 million AIA threshold.

- Claim the Full Amount: You can deduct the entire £5,000 from your profits in the tax year you bought it.

So, if your total profit for the year was £40,000, this single purchase would slash your taxable profit down to just £35,000. That’s an immediate and substantial tax saving, making it much easier to afford the tools that drive your business forward.

It’s vital to get this right. A day-to-day expense is for running the business now, while a capital asset is an investment in its future. Understanding that difference is the key to managing major purchases correctly and claiming every penny of tax relief you’re entitled to.

Choosing Between Simplified Expenses and Actual Costs

When it comes to claiming certain expenses as a sole trader, HMRC gives you a choice: you can either use their straightforward ‘simplified expenses’ system, which relies on flat rates, or you can meticulously track every penny of your ‘actual costs’.

There’s no single right answer here. The best option really depends on your business activities and, frankly, which method will save you the most money.

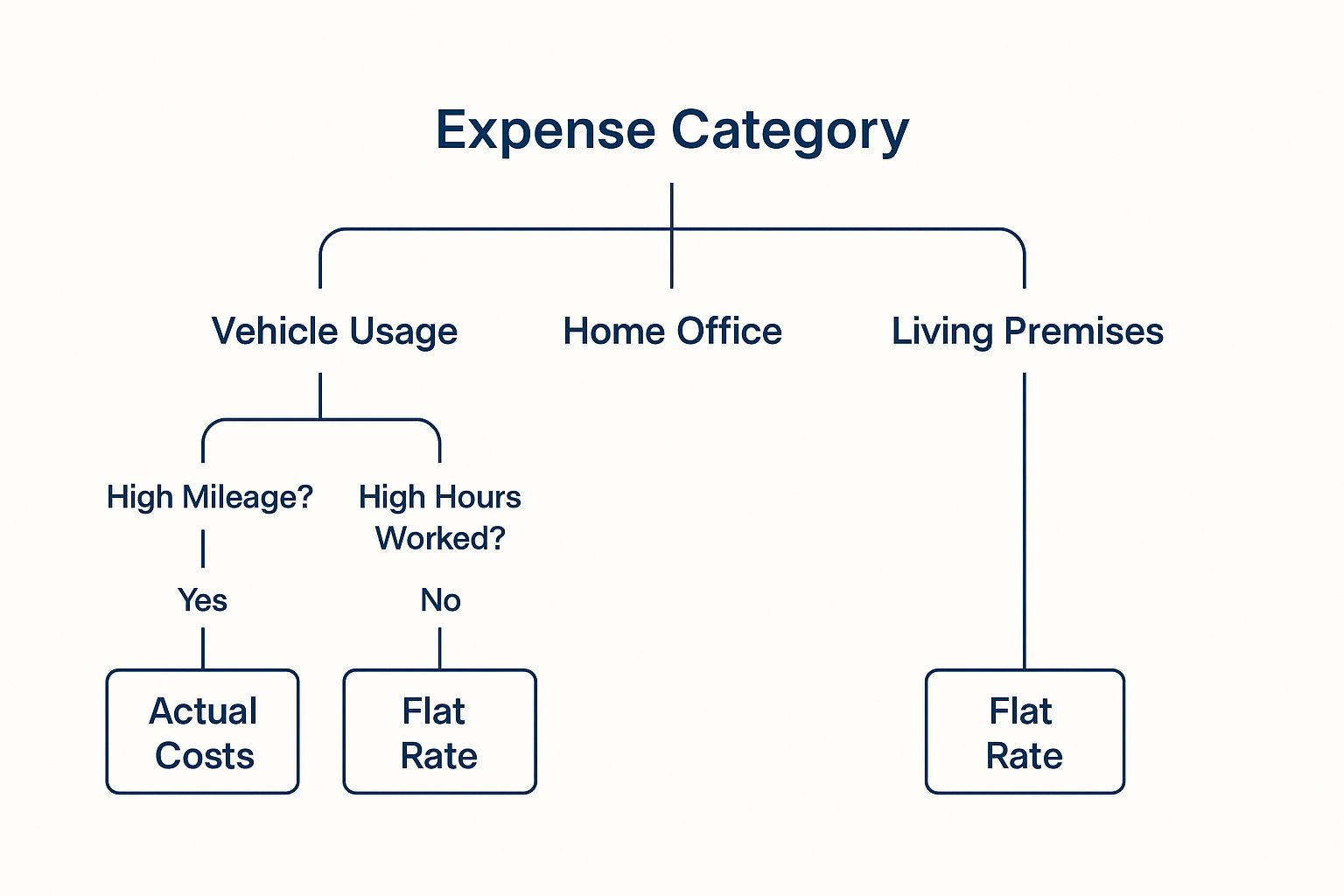

This choice mainly applies to three key areas: using your vehicle for business, working from your home, and living at your business premises (like if you run a bed and breakfast). Getting this decision right can make a real difference to your final tax bill.

For instance, imagine you’re a freelance consultant who drives thousands of miles each year visiting clients. You might find that the true cost of your fuel, insurance, and repairs adds up to way more than the flat-rate mileage allowance. In that case, tracking your actual costs would lead to a bigger, much more welcome deduction.

Simplified Expenses Unpacked

The biggest draw of simplified expenses is convenience. It’s a lifesaver if you hate number-crunching.

Instead of calculating the precise business proportion of your bills, you just use a fixed flat rate set by HMRC. It saves a huge amount of time and hassle.

Here’s how it works in practice:

- Vehicle Usage: You can claim a flat rate of 45p per mile for the first 10,000 business miles you drive in a year, and 25p per mile after that. This single figure is designed to cover everything – fuel, insurance, repairs, and even the car’s depreciation.

- Working from Home: If you work from home for 25 hours or more a month, you can claim a flat monthly amount. This rate changes depending on how many hours you put in.

- Living at Business Premises: For businesses like B&Bs, a flat monthly rate can be deducted from your income to account for your personal use of the property.

This infographic gives you a simple way to think through which method suits you best.

The key takeaway is this: if your usage or costs are high, it’s often better to claim actual costs. If your usage is lower or more consistent, the simplicity of flat rates is probably more appealing.

When to Calculate Actual Costs

Choosing to calculate your actual costs definitely requires more diligent record-keeping, but it can often result in a much larger tax deduction. This method usually wins out if your business-related expenses are higher than what the flat rates would cover.

A delivery driver is a perfect example. Their high mileage means fuel, insurance, and maintenance costs can be massive. By tracking every single receipt and working out the business-use percentage of their total vehicle running costs, they can often claim significantly more than the 45p per mile allowance would give them.

It’s the same story for your home office. If you have a dedicated space that guzzles electricity for specialised equipment, calculating the actual proportion of your utility bills will likely be more rewarding than claiming the simple flat rate.

The rule of thumb is this: if you suspect your actual costs are high, do the calculations. Spend an hour working it out both ways to see which one saves you more cash. That effort could easily put hundreds of pounds back in your pocket.

Before we dive deeper, it’s worth mentioning another handy tool from HMRC called the trading allowance. One of the key sole trader tax deductions available is a tax-free allowance of £1,000 on your self-employment income each year.

If your total business expenses come to less than this amount, you can simply claim the trading allowance instead of itemising every single cost. Be warned, though: you can’t claim both. If your expenses are over £1,000, it’s almost always better to claim the full amount of your actual costs. You can learn more about the tax obligations of sole traders and how the trading allowance fits in.

Building a Bulletproof Record-Keeping System

Think of your records as the foundations of your entire tax return. Get them right, and everything else is solid, stable, and easy to defend if HMRC ever comes knocking. Get them wrong, and the whole thing can feel wobbly and stressful.

Good record-keeping isn’t about becoming a master accountant overnight. It’s simply about creating a straightforward system that you’ll actually use. A robust process makes it effortless to find every single allowable expense when it’s time to file your tax return.

At its heart, your system just needs to track all your business income and every penny you spend. The golden rule from HMRC is to keep all your records for at least five years after the 31st January submission deadline for that tax year. This ensures you’re covered if they have any questions down the line.

Choosing Your Record-Keeping Method

There’s no single “best” way to do this. The best method is the one you’ll stick with consistently.

- Simple Spreadsheets: When you’re just starting out, a basic spreadsheet often does the trick perfectly. Just create columns for the date, a description of the expense, its category (like travel or office supplies), and the amount. It’s a low-cost, no-fuss option.

- Digital Accounting Apps: Modern apps are a game-changer. Many can link directly to your business bank account, automatically sorting transactions for you. Some even let you snap a photo of a receipt with your phone and store it digitally, which can be a massive time-saver.

Whichever path you take, the goal is identical: maintain a clear, organised trail of your business finances. That diligence truly pays off, ensuring you never miss out on a deduction you’re entitled to.

Remember, a lost receipt is lost money. If you can’t prove an expense, you can’t claim for it. A disorganised system directly translates into a higher tax bill.

Essential Documents to Keep

To make your system truly bulletproof, you need to collect and organise the right paperwork. These documents are the evidence that backs up every number on your tax return.

Here’s your essential checklist:

- All sales invoices you issue to your clients.

- All purchase receipts and invoices for things you buy.

- Bank statements from your business account.

- Records of any personal money you’ve invested in the business.

- Key contracts like lease agreements or hire purchase deals.

Let’s bring this to life. When you buy a new laptop for work, don’t just jot down the amount. Keep the receipt (digital or paper) showing the date, the item, and the supplier’s details. If you take a client for a business lunch, the receipt is great, but adding a quick note about who you met and what you discussed makes your record even stronger.

This level of detail gives you the proof needed for all your sole trader tax deductions and gives you total confidence when you submit your figures to HMRC. A well-organised system turns tax time from a frantic scramble into a simple, routine task.

Common Mistakes That Cost Sole Traders Money

Navigating the world of sole trader taxes can feel like a minefield. It’s surprisingly easy to make small errors that lead to a bigger tax bill or, even worse, unwanted attention from HMRC. A few common mistakes pop up time and again, but understanding them is the best way to steer clear.

One of the most frequent slip-ups is misinterpreting the rules around travel. That daily journey from your home to your main workshop or office? That’s just a regular commute in HMRC’s eyes, and it’s not tax-deductible. Trying to claim it can land you in hot water.

Another classic pitfall involves clothing. It seems logical that the smart suit you bought for client meetings should be a business expense, right? Wrong. HMRC is clear that everyday clothing, even if you only wear it for work, doesn’t count. The only time you can claim is for a specific uniform or essential protective gear—think a branded polo shirt for your market stall or steel-toed boots for a construction site.

Mixing Business with Pleasure Without a Split

One of the quickest ways to overclaim is by failing to separate business and personal use for costs that serve both. This happens all the time with things like mobile phones or home internet. If your phone contract is £40 a month and you work out that you use it 80% for business, you can only claim £32 as an expense.

Claiming the whole bill without a fair and logical split is a major red flag for HMRC. Proper apportionment is non-negotiable for any cost that straddles your business and personal life. Getting this wrong doesn’t just risk a tax headache; it can also hurt your bottom line, so it pays to learn how to improve cash flow by keeping your claims squeaky clean.

HMRC’s golden rule is that an expense must be “wholly and exclusively” for business. If there’s a dual purpose, you have to be ready to justify the business percentage you’ve claimed.

Forgetting About National Insurance Contributions

It’s easy to focus so much on your profits that you overlook National Insurance Contributions (NICs), but they are a huge part of your overall tax picture. For sole traders, these aren’t just an afterthought; they’re a significant liability you need to plan for to avoid nasty surprises.

For the 2025 tax year, Class 4 NICs are set at 9% on profits between £12,570 and £50,270, and 2% on anything you earn above that. While Class 2 NICs have been scrapped for most, if your profits fall below the Small Profits Threshold, you can still make voluntary contributions to protect your State Pension record. Getting these numbers right is vital for staying compliant today and securing your financial future.

By sidestepping these common errors—from misjudging travel and clothing claims to forgetting to apportion costs and account for NICs—you can file your tax return with much more confidence. You’ll be sure you’re claiming everything you’re entitled to without ever crossing the line.

Frequently Asked Questions

Getting to grips with tax deductions always throws up a few specific questions. Let’s tackle some of the most common ones sole traders ask, so you can handle your finances with confidence and stay on the right side of HMRC.

Can I Claim Expenses from Before I Started My Business?

Yes, you absolutely can. HMRC calls these ‘pre-trade expenses’, and you can claim for costs incurred up to seven years before you officially started trading.

The golden rule is simple: the expense must be for something that would have been an allowable business cost once you were up and running.

For example: say you’re launching a freelance photography business. Six months before your first client pays you, you buy a professional camera for £2,000 and a domain name for your portfolio website for £15. Both are perfectly valid pre-trade expenses. For tax purposes, HMRC treats them as if you bought them on day one of your business.

How Do I Handle Expenses with Mixed Personal and Business Use?

This is a classic sole trader puzzle. For anything you use for both work and personal life—like your phone or car—you can only claim the business portion of the cost.

The key is to find a fair and reasonable way to split the cost. Crucially, you need to keep good records that show how you arrived at your calculation.

A great example is your mobile phone. Let’s say your monthly bill is £30. You figure out that you use it 70% of the time for business calls, emails, and client messages, and 30% for personal chats. In this case, you can claim 70% of the cost, which works out to a £21 deduction each month. Your itemised phone bill is the perfect evidence to back this up if HMRC ever asks.

Should I Use the Trading Allowance or Claim My Expenses?

The right answer here depends entirely on how much your total business expenses add up to for the year. The £1,000 trading allowance is a tax-free exemption designed to make life simpler, saving you the hassle of logging every single small cost.

The rule of thumb is straightforward: if your total allowable expenses for the tax year are less than £1,000, using the trading allowance is the easiest and most sensible choice. If your expenses add up to more than £1,000, you’ll get a bigger tax deduction by claiming for each individual cost instead.

Just remember, you have to pick one method for the tax year; you can’t use the trading allowance and claim other business expenses on top. This is also something to bear in mind when thinking about your business structure, which you can explore with a sole trader vs limited company calculator to see the bigger picture.

At Grow My Acorn, we’re here to give entrepreneurs the essential information and advice they need to manage their finances like a pro. From understanding tax deductions to picking the right business structure, find the guidance you need at https://growmyacorn.co.uk.