How to Start a Business in the UK

How to Start a Business in the UK- Starting a business isn’t a single event; it’s more like a series of five key phases: coming up with a solid idea, creating a proper business plan, sorting out the legal stuff, finding the money, and finally, launching your brand.

But here’s the most important bit: you have to make sure there’s a real market for your idea before you pour your time and money into it. Getting this first step right is the foundation for everything else, as it proves you’re actually solving a problem that people care about.

From Great Idea to Viable Business

Every successful business starts with a spark of an idea, but an idea alone won’t pay the bills. The very first thing you need to do on this journey is validation—proving that people don’t just like your concept, but will actually open their wallets for it. So many aspiring founders make the mistake of building their dream product in a bubble, only to launch it to the sound of crickets.

Think of the validation phase as your reality check. It’s about shifting your focus from what you think is a brilliant idea to what your potential customers genuinely need. The good news is, you don’t need a huge budget for this. It’s all about being clever and resourceful.

Pinpointing Your Ideal Customer

You can’t test your idea until you know who you’re testing it with. One of the classic pitfalls is aiming way too broad. “Everyone” is not a target market. You need to get laser-focused and paint a detailed picture of your perfect customer.

Let’s take a practical example: a new artisan bakery. Instead of just targeting “people who like bread,” the founder could get much smarter by niching down to one of these groups:

- Health-Conscious Families: Parents on the hunt for organic, sourdough, or whole-grain loaves without any artificial nasties for their kids.

- Local Office Workers: People needing high-quality sandwiches, pastries, and decent coffee for a quick lunch that doesn’t feel like a compromise.

- Gourmet Foodies: Enthusiasts who get excited about unique, experimental flavours and premium ingredients, and are happy to pay a bit more for something special.

Defining your customer this precisely makes everything easier. It helps you shape your products, your marketing messages, and even where you set up shop. It’s the difference between shouting into the wind and having a meaningful conversation with someone who’s already listening. If you’re still brainstorming, our guide on top 20 home-based business ideas might spark some inspiration.

Conducting Lean Market Research

Once you know who you’re talking to, you can start testing your concept without breaking the bank. The whole point is to gather brutally honest feedback and see if there’s any real-world demand.

So, for our artisan bakery, this could look like:

- Setting up a stall at a local farmers’ market: This is a fantastic, low-cost way to test a small range of your best products. Seeing which items sell out first gives you direct, undeniable data on what people actually want to buy.

- Running a simple online survey: Use a free tool like Google Forms to poll people in local community Facebook groups. Ask them about their buying habits, what they’d be willing to pay, and what they feel is missing from the bakeries already in town.

- Creating a “coming soon” landing page: Build a simple one-page website showing off your concept and what makes you different. Add an email sign-up form to see who’s interested. Getting a list of 100 local people keen to hear more is a powerful signal that you’re onto something.

Here’s a quick look at how you can structure your own validation process.

Key Steps for Validating Your Business Idea

This table breaks down the initial validation process, helping you confirm if your business concept has legs before you commit fully.

| Validation Step | Actionable Task | Example (Artisan Bakery) |

|---|---|---|

| 1. Define the Problem | Clearly state the customer problem you are solving. | “Local families struggle to find fresh, preservative-free bread for their children.” |

| 2. Identify the Customer | Create a detailed profile of your ideal customer. | “Health-conscious parents, aged 30-45, living within a 5-mile radius, who shop at farmers’ markets.” |

| 3. Test Your Solution | Create a minimal version of your product/service to get feedback. | Bake a small batch of 3 types of bread (sourdough, wholemeal, seeded) to sell at a market stall. |

| 4. Gather Feedback | Talk to potential customers directly and ask for honest opinions. | Ask market customers what they liked, disliked, and what price they’d expect to pay. |

| 5. Gauge Purchase Intent | Ask people if they would actually pay for it. | Set up a pre-order list or a “notify me on launch” email signup to measure real commitment. |

By following these steps, you move from a simple idea to a concept backed by genuine market interest, significantly boosting your chances of success.

The number of UK startups shot up to 810,316 in 2020-21, fuelled by major shifts in the economy. This shows a massive appetite for entrepreneurship, but proper validation is what separates a fleeting idea from a lasting business—especially when things like the cost of living crisis are making survival tougher than ever.

Building Your Business Plan and Financial Roadmap

Once you’ve tested your idea and are confident it has legs, it’s time to create your blueprint for success. A business plan is often misunderstood as just a stuffy document for securing a loan, but its real value is as your strategic guide. Think of it as the living document that turns your vision into a concrete, actionable strategy.

This plan forces you to think through every single aspect of your venture, from your core mission right down to your marketing tactics. It’s where you spell out what your business does, who it serves, and exactly how it will operate and make money. Getting this clarity is essential for making smart decisions, especially in the chaotic early days.

Articulating Your Core Strategy

Before you even touch a spreadsheet, you need to define the heart of your business. This part of the plan sets the stage and explains why your business deserves to exist. It’s your chance to tell a compelling story about your brand and what makes you different.

A great way to start is to break down the key components. Think about:

- Company Mission: What’s your purpose beyond just making a profit? For example, a sustainable fashion brand’s mission might be: “To make ethical fashion accessible and desirable, reducing the environmental impact of the clothing industry one garment at a time.”

- Structure: Will you be a sole trader, a limited company, or something else?

- Products or Services: What are you actually selling, and what’s the special sauce? For instance, a coffee shop might sell “ethically sourced, single-origin coffee and locally baked pastries.”

- Marketing Strategy: How will you get in front of your target customers and convince them to buy? A practical example could be “Using targeted Instagram ads to reach local young professionals and collaborating with nearby businesses on joint promotions.”

For example, a freelance graphic designer wouldn’t just write, “I design logos.” A much stronger mission would be something like: “To empower local startups with professional, affordable branding that helps them compete with larger companies.” See how that reframes the service around the customer’s success? It’s far more powerful.

To help structure your thoughts and ensure you cover all the essential elements, it’s worth using a professional guide. You can get started with this free business plan template.

Creating Realistic Financial Projections

This is where your big idea meets reality. Financial projections aren’t about plucking numbers out of the air; they’re educated estimates based on solid research and logic. A well-thought-out financial roadmap gives you—and any potential investors—confidence that your business is built on a sustainable foundation.

You’ll need to focus on three critical areas: your startup costs, revenue forecasts, and break-even point. Each one builds on the last to paint a complete financial picture.

One of the most common pitfalls for new entrepreneurs is being wildly over-optimistic. Your financial projections must be grounded in realism, not just hope. It’s always better to plan for a conservative scenario and exceed it than to aim for the stars and run out of cash in month three.

Let’s make this practical and continue with our freelance graphic designer example.

1. Estimate Your Startup Costs

First, list every single one-off expense required to get the doors open. This means everything from your laptop to your legal fees. Don’t forget anything.

- Hardware: High-performance laptop (£1,500)

- Software: Adobe Creative Cloud subscription (£50/month), accounting software (£20/month)

- Business Registration: Company registration fee (£12)

- Marketing: Website development (£500), initial online ads (£200)

- Insurance: Professional indemnity insurance (£150/year)

- Contingency Fund: A buffer for unexpected costs (£500)

Based on this, your initial one-time outlay is around £2,712, with ongoing monthly costs of roughly £70 before you’ve even started a project.

2. Forecast Your Revenue

Next, project your income for the first one to three years. Instead of just guessing, base it on your capacity and pricing strategy.

Our designer could create different client tiers to make this more tangible:

- Tier 1 (Small Projects): 2 logo designs per month at £400 each = £800/month

- Tier 2 (Medium Projects): 1 branding package per month at £1,200 = £1,200/month

- Tier 3 (Retainer Clients): 1 ongoing client at £500/month = £500/month

This simple model projects a monthly revenue of £2,500. It’s far more credible and useful than just saying, “My goal is to make £30,000 in the first year.”

3. Calculate Your Break-Even Point

Finally, work out your break-even point—the amount of revenue you need to generate just to cover all your costs. Using the figures above, the designer has monthly fixed costs of £70. They need to earn at least that much just to avoid losing money. Every pound earned after that point contributes to profit. This simple calculation tells you the absolute minimum you need to achieve to stay afloat.

Navigating UK Business Legal and Financial Setup

With a solid plan in hand, it’s time to build the official structure that turns your idea into a legitimate business. This stage can feel a bit daunting, full of jargon about tax and liability, but getting it right from day one is one of the most important steps you’ll take.

This framework is what protects you, defines your financial responsibilities, and sets you up for proper growth down the line.

Choosing Your Business Structure

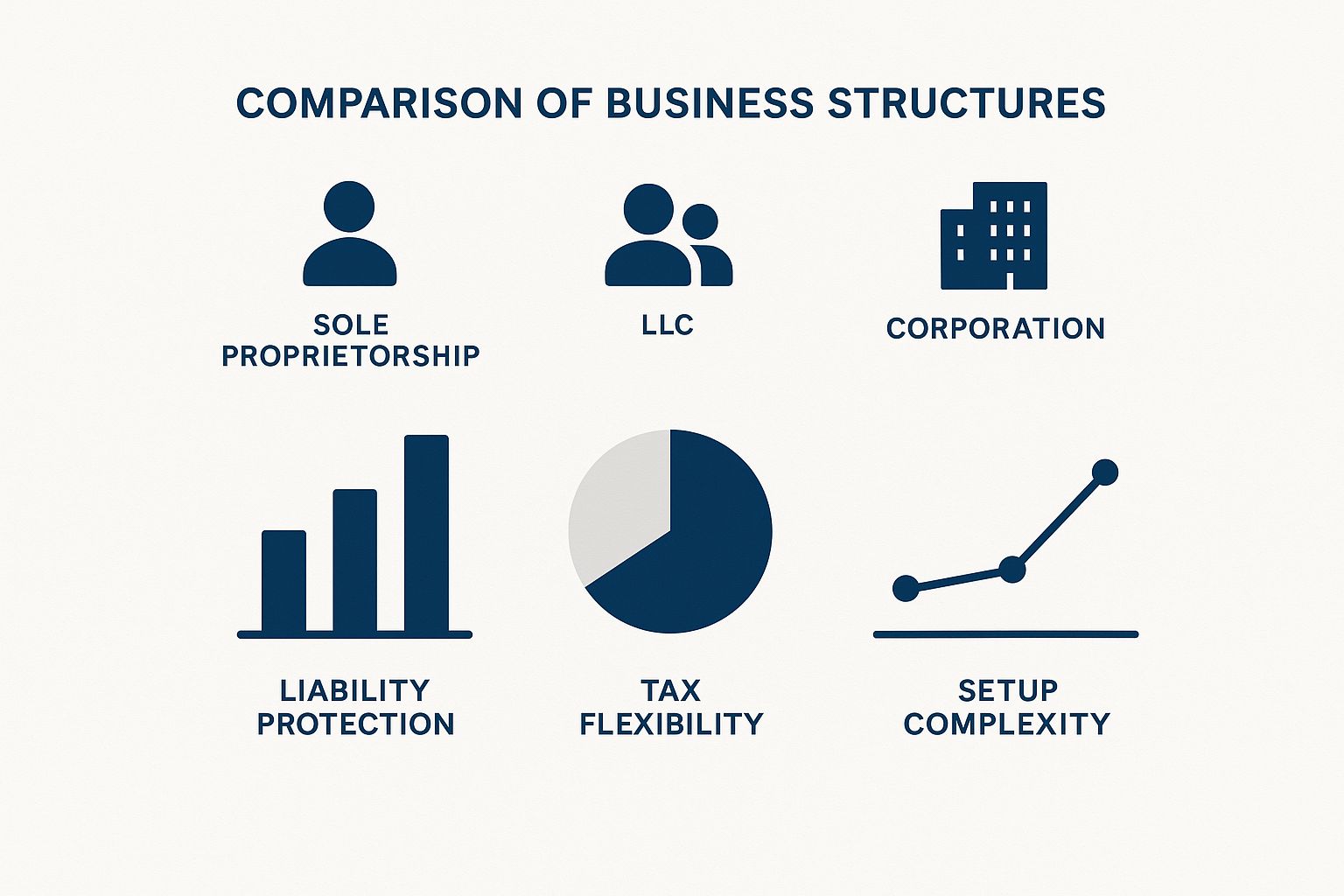

The first, and most significant, decision is picking your legal business structure. This choice dictates everything from your personal liability to how you pay your taxes. In the UK, there are three main paths for new entrepreneurs, and there’s no single “best” option. The right choice depends entirely on your personal circumstances, appetite for risk, and long-term goals.

Here’s a quick rundown of the most common setups:

- Sole Trader: This is the simplest and quickest way to get started. You and the business are legally the same entity, which means you’re personally responsible for any debts. It’s a great fit for freelancers, consultants, or small one-person operations where the risk of personal liability is low. Example: A freelance writer or a personal trainer starting out on their own.

- Limited Company (Ltd): Forming a limited company creates a separate legal entity from you as an individual. This is a game-changer because it protects your personal assets (like your home) if the business runs into financial trouble. It often looks more professional to clients and is essential if you plan to seek investment, but it does come with more administrative duties. Example: A small digital marketing agency or a local construction company.

- Partnership: If you’re starting a business with someone else, a partnership is a straightforward option. Much like a sole trader, the partners share profits and are personally liable for business debts. You’ll absolutely need a solid partnership agreement to outline responsibilities, profit splits, and what happens if someone wants to leave. Example: Two chefs opening a catering business together.

This infographic gives a clear, at-a-glance comparison of how these structures handle liability, tax, and the complexity of getting set up.

Unsure of which business structure is most suitable? Take a look at our Choosing the Right Business Structure post. To check the tax implications with our Sole Trader Vs Limited Company calculator

As you can see, there’s a direct trade-off. Simpler structures offer less personal protection, while the more complex ones provide greater security but come with more admin. For a deeper dive into these options, have a look at our full guide on choosing the right business structure in the UK.

To make it even clearer, let’s compare the main options side-by-side.

Comparing UK Business Structures

Choosing a business structure sets the foundation for your tax, liability, and administrative responsibilities. This table breaks down the key differences between the most common choices for new UK businesses

| Feature | Sole Trader | Limited Company (Ltd) | Partnership |

|---|---|---|---|

| Liability | Unlimited – your personal assets are at risk. | Limited – personal assets are protected. | Unlimited – all partners are personally liable for debts. |

| Tax | You pay Income Tax and National Insurance via Self Assessment on all profits. | The company pays Corporation Tax. You pay tax on salaries and dividends. | Partners pay Income Tax and National Insurance on their share of the profits. |

| Admin | Low – just need to register with HMRC and file an annual tax return. | Higher – requires registration with Companies House, annual accounts, and confirmation statements. | Low – each partner registers with HMRC, but you’ll need a solid partnership agreement. |

Ultimately, the decision comes down to balancing simplicity against protection. A sole trader is perfect for getting started quickly with minimal fuss, but a limited company offers invaluable protection as your business grows and takes on more risk.

Registering Your Business and Managing Finances

Once you’ve settled on a structure, you need to make it official.

If you go down the sole trader route, you must register for Self Assessment with HMRC and file a tax return each year. For a limited company, the process involves registering with Companies House, which can cost as little as £50 online.

This registration formally establishes your business and sets your tax obligations in motion. You’ll be responsible for paying Corporation Tax on profits (for limited companies), Income Tax via Self Assessment (for sole traders), and National Insurance contributions. Keep an eye on your turnover, too—if it’s projected to exceed £90,000 in a 12-month period, you must also register for VAT.

The next step is non-negotiable: open a dedicated business bank account.

Mixing personal and business finances is a recipe for disaster. A separate business account creates a clean financial record, simplifies bookkeeping, makes tax returns far easier, and presents a more professional image to clients and suppliers.

Keeping your finances separate isn’t just good practice; it’s essential for accurately tracking your cash flow and proving you’re financially stable to lenders or investors down the line.

Protecting Your Venture with Business Insurance

Finally, let’s talk about protection. Starting a business is inherently risky, but you can head off many potential threats with the right insurance. It’s a step that far too many new founders overlook, often with devastating consequences.

For most new businesses, three types of cover are absolutely essential:

- Public Liability Insurance: This protects you if a member of the public is injured or their property is damaged because of your business activities. Think of a client tripping over a cable in your home office or a product you sell causing an allergic reaction. A practical example would be a window cleaner accidentally dropping a bucket on a client’s car.

- Professional Indemnity Insurance: This is crucial if you provide services or advice. It covers you against claims from clients who believe you’ve made a mistake or given poor advice that cost them money. For instance, if a business consultant gives advice that leads to a financial loss for their client.

- Employers’ Liability Insurance: This isn’t optional—it’s a legal requirement the moment you hire your first employee. It covers compensation costs if an employee becomes ill or is injured because of the work they do for you. A real-world case could be a cafe worker slipping on a wet floor and breaking their arm.

Getting the right legal, financial, and insurance foundations in place might not be the most glamorous part of starting a business, but it’s what allows you to operate with confidence and security.

Securing the Right Funding for Your Venture

A brilliant business plan is the map, but funding is the fuel that actually gets the engine started. Finding the right capital is the critical step that transforms your ideas into a real, functioning business.

The funding landscape can seem complex, but it’s all about matching the right type of money to your specific needs, your goals, and how much control you’re willing to give up. The journey of how to start a business often begins close to home, so understanding your options—from your own savings to pitching seasoned investors—is essential. Each path has its own set of rules and trade-offs.

Starting with Your Own Resources

The most common and straightforward way to fund a new business is through bootstrapping. This simply means self-funding your venture using your personal savings or the cash flow from your very first sales. The main advantage is crystal clear: you retain 100% ownership and control. You answer to no one but yourself and your customers.

A practical example is the story of Ben Francis, who started the gym apparel brand Gymshark from his parents’ garage, using money he earned as a Pizza Hut delivery driver to buy a screen printer. He reinvested every penny from early sales back into the business, maintaining full control.

Bootstrapping forces discipline and creativity. When every pound comes from your own pocket, you become incredibly resourceful, focusing only on activities that generate a direct return. This can build a lean, resilient business from day one.

Exploring External Funding Avenues

When personal savings just aren’t enough to get your idea off the ground, it’s time to look for external capital. Here in the UK, there are several well-trodden paths for new entrepreneurs, each suited to different types of businesses.

The most traditional route is a bank loan. Banks are typically risk-averse, so they’ll want to see a rock-solid business plan, strong financial projections, and often some form of collateral. They are lending you money they expect to be paid back with interest, so their focus is squarely on your ability to generate consistent cash flow. For example, a local plumber seeking £10,000 to buy a new van and tools would present their business plan and one year of accounts to a high street bank.

A much more accessible option for many is a government-backed Start Up Loan. These are personal loans specifically for business purposes, available for amounts between £500 and £25,000. The great thing about this scheme is that it comes with free business support and mentoring, making it an excellent choice for first-time founders who need guidance as well as cash.

Attracting Investors and a Community

If your business has high-growth potential, you might want to consider seeking investment from angel investors or, at a later stage, venture capitalists. Unlike a bank, investors don’t just lend you money; they buy a share of your company. They are betting on your future success and expect a significant return on their investment when the company grows or is eventually sold.

An angel investor is typically a wealthy individual who invests their own money and often brings invaluable industry experience and connections to the table. They’re looking for a compelling story, a scalable business model, and, most importantly, a founder they truly believe in. Your pitch needs to sell the vision, not just the numbers.

Another increasingly popular method is crowdfunding. Platforms like Kickstarter or Crowdcube allow you to raise small amounts of money from a large number of people. This can be a fantastic way to validate your product and build a community of loyal customers before you’ve even launched.

Let’s look at a real-world example. A UK-based eco-friendly cleaning product company needed £15,000 for its first large-scale production run. Instead of a loan, they launched a Kickstarter campaign offering pre-orders of their product as “rewards.” Not only did they hit their funding goal in under a month, but they also secured 500 new customers and generated significant press coverage.

This just goes to show the power of crowdfunding for more than just raising money—it’s a marketing and market validation tool, all in one. Choosing your funding path is a strategic decision that will shape the entire future of your business.

Right, you’ve sorted the legal stuff and your finances are in order. Now comes the exciting part: shifting your focus from the inside out. Having a brilliant product or service is fantastic, but it’s only half the story. The other, arguably more important, half is making sure the right people actually know you exist.

This is where building a memorable brand and rolling out a smart launch plan comes into play. Forget what you think you know about branding – it isn’t just a fancy logo or a snappy business name. It’s the entire experience someone has with your business. It’s the feeling they get from your website, the tone of your emails, and the promise you implicitly make every time they interact with you. It’s what makes you you, and not just another option in a crowded market.

Crafting Your Brand Identity on a Budget

Building a strong brand doesn’t mean you need a bottomless marketing budget. Far from it. It starts with two things that cost nothing: clarity and consistency. The first job is to nail down your brand voice. Are you going to be friendly and fun, or are you aiming for a more authoritative, expert tone? Your voice needs to connect with your ideal customer and stay the same everywhere, from your website copy to your social media replies.

With your voice sorted, you just need a few core visual pieces to get started:

- Business Name: Go for something that’s memorable, easy to say, and gives a clue about what you do. Crucially, check that the name isn’t already trademarked and that you can get the website domain for it.

- Simple Logo: You don’t need to hire a world-class designer on day one. Tools like Canva are brilliant for creating a clean, professional logo that looks great on your website and social profiles without breaking the bank.

- Colour Palette: Pick two or three main colours that capture your brand’s personality. Use them consistently across everything you create, from flyers to Instagram posts.

Let’s imagine you’re launching a local dog-walking service called “Pawsitive Steps”. The brand voice would naturally be warm, trustworthy, and a bit playful. The logo could be a simple paw print inside a heart, and you might choose an earthy green and a friendly blue to suggest a connection to nature and reliability. See? Simple, but effective

Building Your Online Presence

Think of your website as your digital shop window. It’s often the very first place a potential customer will look you up, so it needs to be professional, easy to get around, and crystal clear about what you offer. You don’t need to be a coding genius, either. Platforms like Squarespace or Wix make it surprisingly easy to build a site that looks like it cost a fortune.

Beyond your website, you need to show up where your customers are already hanging out. Don’t fall into the trap of trying to be on every single social media platform at once. It’s a recipe for burnout. Instead, pick one or two that make the most sense. For our “Pawsitive Steps” dog walker, a visual platform like Instagram is a no-brainer for sharing photos of happy dogs. A local Facebook page would also be perfect for getting involved in the community.

Entrepreneurship is a vibrant and growing opportunity across the country. In the first half of 2025, the UK saw a huge rise in startup activity, with 426,000 new businesses registered. The North East led this revival with a 19% growth in new startups, showing that great businesses can thrive anywhere. Discover more about the recent surge in UK startup activity.

A Low-Cost Launch Plan to Get Your First Customers

Now it’s time to get your brand out there and bring in those all-important first customers. Forget about splashing cash on expensive ads. What you need is a targeted plan that delivers a real punch.

Let’s stick with our “Pawsitive Steps” dog-walking service for a practical, three-pronged launch strategy that costs next to nothing:

- Get Found on Google, for Free: The first thing a local dog owner is going to do is search for “dog walkers near me.” You need to be there when they do. Set up a free Google Business Profile with your name, address, hours, and plenty of photos. As soon as you get your first clients, gently encourage them to leave a review. Those stars are gold dust for boosting your visibility.

- Get Stuck into Your Community: Become a familiar, helpful face in local Facebook groups for your town or specific neighbourhoods. Don’t just drop links to your service and run. That’s spam. Instead, share useful tips on dog care, answer questions people have, and build genuine relationships. You’ll quickly become the go-to local expert.

- Use Smart Offline Marketing: Don’t dismiss old-school methods, because they still work brilliantly for local services. Design a clean, professional flyer and get it up in places your ideal customers go—think local vets, pet shops, and community notice boards in parks. An introductory offer for the first 10 clients is a great way to create a bit of buzz and get your first regulars on the books.

Common Questions About Starting a UK Business

Getting a new venture off the ground can feel like wading through a maze of legal, financial, and practical questions. While we’ve covered the main path for setting up your business, most founders I talk to have specific queries that pop up along the way.

Here are some quick, no-nonsense answers to the questions entrepreneurs ask most often when they’re starting out in the UK.

How Much Money Do I Realistically Need to Start?

Ah, the classic “how long is a piece of string?” question. Startup costs vary wildly, and the most important thing is to be brutally realistic about what your specific business needs.

A service-based business, like a freelance copywriter, can often get going for under £1,000. That would typically cover the essentials: registering the business, getting a simple website live, paying for necessary software, and a small budget for your first few online ads.

On the other hand, a product-based business like a local coffee shop will have much higher upfront costs. You’ll need to factor in a deposit on the premises, an espresso machine, your initial stock of coffee and cakes, and staff wages. This can easily push your startup capital into the tens of thousands.

The best way to find your number is to build a detailed spreadsheet. List every single potential one-off cost (like equipment or legal fees) and all your ongoing monthly expenses for at least the first six months (rent, marketing, salaries). This exercise transforms a vague idea into a tangible funding target.

Can I Start a Business While Still Employed?

Absolutely, and it’s a very common way to do it. Launching your venture as a “side hustle” is a brilliant way to test the waters and start building an income stream with the safety net of your regular salary still in place. It takes a huge amount of pressure off in those early days.

But you have to do your homework first. Before you do anything else, dig out your current employment contract and read it carefully. Look for any clauses that might restrict or even forbid you from running an external business, especially if it’s in a similar field to your employer.

Balancing a full-time job with a new business also demands serious discipline. Be honest with yourself about whether you can dedicate enough time and energy to give your new venture a real chance of success without letting your performance at your day job suffer.

What Is the Most Common Mistake New Business Owners Make?

One of the most frequent—and potentially fatal—mistakes I see is underestimating the importance of cash flow. It’s a term that’s easily confused with profit, but they are two very different beasts.

A business can look profitable on paper but still fail if it runs out of actual cash in the bank. For instance, you might make a £5,000 sale (which feels like a great profit!), but if your client doesn’t pay that invoice for 90 days, you won’t have that money to cover your rent or pay suppliers in the meantime.

To avoid this classic trap, you must:

- Create a cash flow forecast: This is a simple document that tracks the actual money moving in and out of your bank account each month.

- Manage your invoices like a hawk: Send them out promptly and follow up on late payments without delay. Don’t be shy about it.

- Keep a cash reserve: Always try to maintain a financial buffer to cover at least three to six months of your essential expenses. It’s your lifeline for unexpected emergencies.

Navigating these early challenges is a core part of the entrepreneurial journey. For more guides and resources to help you build a resilient and successful venture, explore the wealth of information available at Grow My Acorn.