How to Register a Business in the UK Your Complete Guide

How to Register a Business in the UK – So, you’re ready to make your business official in the UK? Excellent. The first step on the ladder is registering your new venture, which usually means choosing between being a sole trader with HMRC or forming a limited company through Companies House. This isn’t just paperwork; it’s a foundational decision that dictates your tax, liability, and admin duties from day one.

Choosing Your Business Structure Before You Register

Before you even think about filling out a form, the most critical decision you’ll make is your business structure. This choice goes far beyond a simple box-ticking exercise. It fundamentally shapes how you operate, how you’re taxed, and the level of personal financial risk you’re prepared to shoulder.

Think of it like choosing the right vehicle for a long journey. A freelance copywriter just starting out might opt for the nimble simplicity of a sole trader setup—it’s like a scooter, quick to get going with minimal fuss. For example, Maria, a freelance writer, can register as a sole trader in 15 minutes and immediately start invoicing clients. On the other hand, a tech startup with big ambitions for investment needs the credibility and protection of a limited company. That’s more like a sturdy van, built to carry more weight and keep its contents safe.

Understanding Your Primary Options

Your goals, appetite for risk, and vision for the future will all point you in the right direction. For most new entrepreneurs in the UK, especially if you’re deciding between going it alone or teaming up with a co-founder, the choice usually boils down to two main paths.

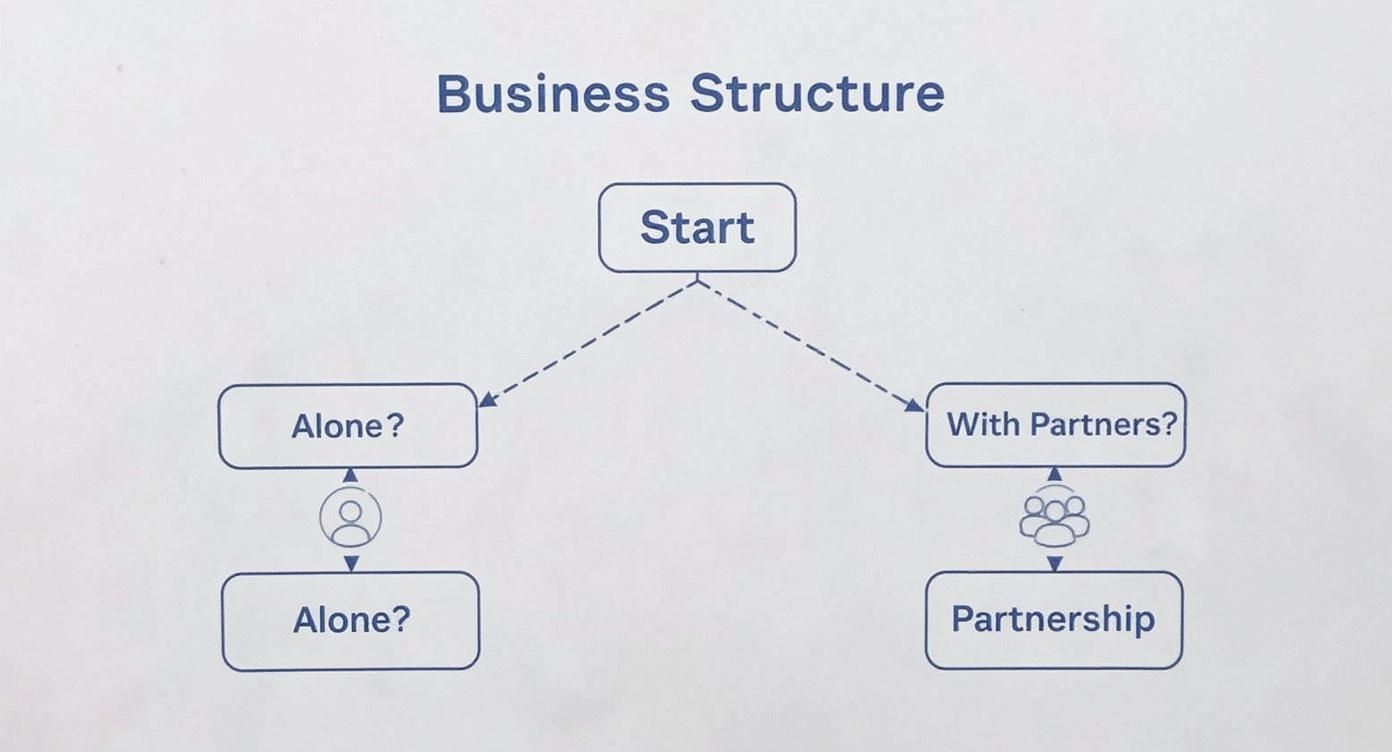

This decision tree gives you a simple way to visualise that first choice.

As you can see, the number of founders is the first fork in the road, pointing you naturally towards either a sole trader or a partnership structure as the most logical starting points.

The Real-World Impact of Your Choice

Let’s get practical. Imagine a graphic designer launching a freelance career. Speed and low costs are their priorities. By registering as a sole trader with HMRC, they can be up and running in minutes with no registration fee. The catch? Their business and personal finances are legally the same, meaning if they take out a £5,000 business loan and can’t repay it, their personal savings could be used to settle the debt.

Now, picture two friends launching an online clothing brand. They plan to seek funding and hire staff within a year. For them, forming a limited company is the only sensible route. This creates a separate legal entity, shielding their personal assets (like their homes) if the business gets into debt. It also looks far more professional to investors, suppliers, and future employees. If they weren’t quite ready for incorporation, a partnership offers a middle ground, formalising their agreement but still leaving them personally liable.

Choosing a business structure isn’t just a legal formality; it’s a strategic decision that aligns your legal framework with your commercial ambitions. Get this wrong, and you could face unnecessary tax burdens or personal financial risk.

To help you see the key differences at a glance, here’s a breakdown of the most common structures.

UK Business Structures at a Glance

| Feature | Sole Trader | Limited Company | Partnership |

|---|---|---|---|

| Legal Status | You and the business are one legal entity. | A separate legal entity from its owners. | Two or more people share ownership. |

| Liability | Unlimited personal liability for business debts. | Limited liability; personal assets are protected. | Unlimited personal liability for all partners. |

| Tax | Pay Income Tax on profits via Self Assessment. | Pays Corporation Tax on profits. | Partners pay Income Tax on their share of profits. |

| Admin | Simple annual tax return. | More complex: annual accounts and confirmation statement. | A partnership tax return plus individual Self Assessments. |

| Best For | Freelancers, contractors, and small one-person businesses. | Businesses aiming for growth, seeking investment, or needing credibility. | Professional services or businesses run by two or more co-founders. |

This table shows the clear trade-offs between simplicity and protection. Your choice really depends on where you see your business heading in the next few years.

A Growing Trend Towards Incorporation

Recent data reveals a clear shift in how UK entrepreneurs are setting up. As of March 2025, there were 2.73 million businesses registered for VAT and/or PAYE. Of those, incorporated companies make up a growing majority at 76.7%, while the slice of sole proprietors and partnerships has shrunk to just under 20%.

Why the shift? It’s largely driven by the liability protection and enhanced credibility a limited company provides. You can discover more insights about UK business demographics from the ONS to see the full picture.

Ultimately, getting this right from the start is crucial. You can dive deeper into the nuances with our detailed guide on choosing the right business structure in the UK. Making the right call now ensures you build your new enterprise on a solid legal and financial foundation.

Registering as a Sole Trader with HMRC

If you’re launching a freelance career or kicking off a small, one-person venture, becoming a sole trader is usually the most straightforward way to get up and running. It’s the simplest and quickest path to making your business official, which is why it’s such a popular choice for millions in the UK.

The process itself is just about letting HM Revenue and Customs (HMRC) know that you’ll be paying your tax through Self Assessment. It’s perfect for a personal trainer, a freelance writer, or a crafter selling their work online. The real beauty of it is the minimal admin, which lets you focus on what really matters: building your client base and getting paid. You can get the whole thing done online in one sitting.

What You Need Before You Start

To make the registration process as painless as possible, it helps to get your ducks in a row first. Gathering a few key bits of information beforehand will save you from frantically digging through drawers midway through the online form.

Make sure you have the following to hand:

- Your National Insurance (NI) Number: This is non-negotiable, as it’s how HMRC identifies you. You can find it on old payslips, P60s, or any letters about tax and benefits.

- Your Personal Details: Just the basics – your full name, date of birth, address, and contact details.

- Your Business Details: You’ll need to know your business name, the date you started trading, and a simple description of what you do (e.g., “graphic design services” or “personal training”).

Imagine a personal trainer, Alex, launching a new fitness service. Before even heading to the GOV.UK website, Alex finds their NI number from an old payslip, confirms their start date was the 1st of the month, and decides to trade under “Alex Smith Fitness.” With this info organised, the registration will be a breeze.

Don’t forget this date: you must register for Self Assessment by the 5th of October in your business’s second tax year. Missing it can lead to penalties from HMRC, so get it in your calendar.

Once you’ve submitted everything, HMRC will get you set up for Self Assessment and post you a Unique Taxpayer Reference (UTR) number. This ten-digit number is your key identifier for everything tax-related and is essential for filing your annual return. Keep it somewhere safe!

Understanding Your Financial Obligations

Getting registered is just the first step. The real test is understanding what comes next, so you can stay compliant and manage your money well from day one. As a sole trader, you are personally responsible for your business’s taxes and National Insurance contributions.

This means you’ll need to get your head around two types of National Insurance:

- Class 2 National Insurance: A flat weekly rate you pay if your profits are above a certain threshold. It’s what contributes to your state pension and other benefits.

- Class 4 National Insurance: This is a percentage of your annual profits above a specific limit.

Both of these are calculated and paid alongside your Income Tax when you file your annual Self Assessment tax return. For example, if a freelance photographer makes £40,000 in profit, they’ll pay income tax on that amount, plus Class 2 and Class 4 National Insurance contributions. To avoid this pain, get into the habit of setting aside a chunk of every payment you receive—25-30% is a good rule of thumb—in a separate savings account.

Setting up a simple bookkeeping system right away will make your life infinitely easier. A basic spreadsheet tracking all your income and expenses is a fantastic starting point. It doesn’t just show you how your business is doing; it also means you’re ready for your tax return and can claim every allowable expense you’re entitled to. You can find out more about what counts in our guide to UK sole trader tax deductions. Good record-keeping is the foundation of smart financial management for any new business owner.

Incorporating a Limited Company

If protecting your personal assets is a big priority, or you have ambitions to scale, seek investment, or build a brand with serious credibility, incorporating a limited company is the definitive next step. It creates a distinct legal shield between you and the business, but this protection comes with a more detailed registration process through Companies House.

Going down this route is your roadmap to establishing a formal, recognised business entity. Unlike being a sole trader, this involves appointing directors, defining shareholders, and preparing foundational legal documents. While it might sound a bit daunting, the online process is surprisingly manageable, even for first-time founders.

Key Roles and Responsibilities

When you incorporate, you create a formal structure with legally defined roles. It’s absolutely essential to understand who does what before you start your application, as you’ll need to name these individuals and provide their details.

- Directors: These are the people responsible for running the company. They must be at least 16 years old and are legally obliged to act in the company’s best interests. You must have at least one director.

- Shareholders (or Members): These are the owners of the company. A company can have just one shareholder, who can also be the director.

- Company Secretary: This is no longer a legal requirement for private limited companies, but some still choose to appoint one to handle administrative tasks.

Let’s imagine two friends, Chloe and Ben, who are launching an e-commerce brand selling sustainable homeware. They agree to be co-directors and equal shareholders, each owning 50% of the company. This kind of clarity from the outset is crucial.

Preparing Your Essential Documents

Before you dive into the online portal, you’ll need a few key documents and decisions ready to go. The most important of these are the ‘memorandum’ and ‘articles of association’.

The memorandum of association is just a simple statement from the initial shareholders confirming they agree to form the company. The articles of association are the rules for running the company, agreed upon by the directors and shareholders. Fortunately, for most standard setups, you can use the default ‘model articles’ provided by Companies House, which simplifies things greatly.

Chloe and Ben decide the model articles are perfect for their needs. This saves them time and the legal costs of drafting bespoke rules, allowing them to focus on their business plan instead.

Setting up a limited company formalises your venture, making it a separate legal “person.” This means the company can own assets, enter into contracts, and be sued in its own name, protecting your personal finances from business liabilities.

Another key piece of information you’ll need is your Standard Industrial Classification (SIC) code. This code tells Companies House what your business actually does. Chloe and Ben search the official list and find the SIC code for “Retail sale via mail order houses or via Internet,” which perfectly describes their e-commerce brand. Choosing the right code is important for statistical purposes and can influence how lenders or investors see your business.

Navigating the Registration Process

With their roles defined and details prepared, Chloe and Ben are ready to register. The most common method by far is online via the Companies House web incorporation service. It’s the fastest and cheapest way to get it done.

The landscape for new businesses is always shifting. For instance, after a record 890,500 new registrations in the financial year ending 2024, the following year saw a 10% drop to 801,864. This downturn was influenced by several factors, including a significant administrative change: the incorporation fee at Companies House was increased from £12 to £50 in May 2024 to fund new transparency measures.

For Chloe and Ben, this £50 fee is a straightforward startup cost they factor into their initial budget. To complete the registration, they will need to provide:

- The company’s chosen name and registered office address.

- Details of at least one director and at least one shareholder.

- The SIC code describing their business activities.

- Information on the company’s shares, known as a ‘statement of capital’.

Choosing a company name requires a bit of care. It must be unique and can’t contain sensitive words or be too similar to an existing name on the register. For a complete walkthrough, check out our guide on how to register a business name with Companies House.

Once their application is submitted and the fee is paid, Companies House will review it. If everything is in order, they’ll receive a Certificate of Incorporation, and their company will officially exist, ready to start trading.

Your Post-Registration Checklist

Holding that registration confirmation is a fantastic feeling. It’s the moment your idea becomes a tangible, official entity. But this milestone is the starting line, not the finish line. To go from a newly registered business to one that’s fully operational, compliant, and protected, there are a few immediate and non-negotiable next steps.

Think of this as your post-registration action plan. Getting these foundations in place right away will save you from future headaches, potential fines, and administrative chaos. It’s all about building a solid operational base so you can focus on what really matters: growth.

Open a Dedicated Business Bank Account

This should be the very first thing on your list, no matter your business structure. Even if you’re a sole trader, mixing business and personal finances is a recipe for disaster. A separate business bank account isn’t just a good idea; it’s essential for clear financial management.

Why is this so important?

- Financial Clarity: It makes tracking income and expenses incredibly simple, giving you a real-time view of your business’s health.

- Professionalism: Paying suppliers and receiving money from clients through a business account builds credibility and trust from day one.

- Tax Simplicity: When it’s time to file your Self Assessment or company tax return, having all your business transactions in one place makes the process infinitely easier.

Imagine a freelance web developer who uses their personal account for everything. When tax season arrives, they have to painstakingly sift through a year’s worth of transactions, trying to separate their weekly food shop from a client payment. A dedicated business account avoids this completely.

Checkout our guide to High Street Vs Digital Business Banks

Register for Corporation Tax Promptly

This step is a legal requirement specifically for limited companies. Once you’re incorporated with Companies House, you must also register for Corporation Tax with HMRC. This isn’t optional.

You have a strict deadline for this: you must register for Corporation Tax within three months of starting to do business. This could include buying, selling, advertising, renting a property, or employing someone.

Missing this deadline can land you with financial penalties and unnecessary stress right at the start of your journey. After you register, HMRC will send your company’s Unique Taxpayer Reference (UTR) to your registered office address. You’ll need this UTR for all future dealings with them, so keep it safe.

Get the Right Business Insurance

Insurance isn’t just a “nice-to-have”; for many businesses, it’s a legal and operational necessity. The type of cover you need depends entirely on what your business does and the risks it faces.

Let’s look at a practical example. A new coffee shop opens its doors. A customer slips on a wet floor and gets injured. Without public liability insurance, the coffee shop owner could be personally liable for thousands in legal fees and compensation. This insurance covers claims made by members of the public for injury or property damage.

Here’s another scenario: an IT consultant gives a client advice that leads to a major data breach. Professional indemnity insurance would protect the consultant against claims of negligence or mistakes in their professional services.

Common types of business insurance to consider include:

- Public Liability Insurance: Essential for any business that interacts with the public.

- Professional Indemnity Insurance: Crucial for those providing advice or professional services.

- Employers’ Liability Insurance: A legal requirement if you hire any staff, even part-time.

Understand Your Ongoing Compliance Duties

Registering your business is just the beginning of your relationship with Companies House and HMRC. Staying compliant is an ongoing responsibility that protects your business’s legal standing and helps you avoid nasty penalties.

Recent trends really highlight the importance of staying on top of your legal duties. Company dissolutions in the UK reached an all-time high in the financial year ending 2025, with 726,735 businesses being removed from the register. This represents a significant 9.6% increase from the previous year, partly driven by new powers allowing Companies House to more actively strike off non-compliant companies.

This data underscores that understanding how to register a business is only half the battle; maintaining it is just as critical. You can explore more about these UK company formation and dissolution trends to appreciate the current business environment.

For limited companies, your key annual tasks include filing a Confirmation Statement and submitting Annual Accounts. For sole traders, the main obligation is filing your Self Assessment tax return on time. Staying organised from day one makes meeting these deadlines a routine task rather than a last-minute panic.

Common Registration Mistakes to Avoid

Getting your business registration wrong can lead to delays, fines, and a whole lot of unnecessary confusion. Simple oversights can quickly snowball into rejected applications, a poor credit rating with HMRC, and a lot of stress you just don’t need when you’re starting out.

The good news is that most of these pitfalls are easy to sidestep. Getting a few key details right from the start—like checking your business name, finding the correct SIC code, and noting down key deadlines—makes a world of difference.

Picking a Business Name That’s Too Similar

Choosing a name that sounds a lot like an existing brand is one of the fastest ways to get your application rejected or, worse, land you in legal hot water. For instance, if you wanted to start a coffee shop called “Star-bucks Coffee Ltd,” it would be immediately rejected for being too similar to an existing trademarked name.

To prevent these kinds of clashes, do your homework first.

- Use the Companies House webCHeck service to see if your name is truly unique.

- Check the UK Intellectual Property Office database for any trademark conflicts.

- While you’re at it, secure a matching domain name to protect your brand online.

- Checkout our Company Name Availability Checker Tool

A unique name isn’t just an administrative tick-box; it’s a legal shield and a valuable marketing asset.

Choosing the Wrong SIC Code

Your Standard Industrial Classification (SIC) code tells HMRC and other bodies what your business actually does. Assigning the wrong one can seriously misrepresent your activities. I remember a tech consultant who accidentally listed the SIC code for retail, which understandably confused lenders when he applied for a business loan.

If you choose incorrectly, you could face misaligned tax rates or find banks questioning your business plan.

- Review the official SIC code list on GOV.UK.

- Find the code that best matches your core business activity.

- If your services span multiple categories, it’s always a good idea to ask an accountant for advice.

| Activity Example | Incorrect SIC Code | Correct SIC Code |

|---|---|---|

| IT consulting | 47910 (Retail sale via mail order houses or via Internet) | 62020 (Information technology consultancy activities) |

| Graphic Design | 82990 (Other business support service activities n.e.c.) | 74100 (specialised design activities) |

Missing the Corporation Tax Deadline

Once you’ve formed a limited company, the clock starts ticking. You must register for Corporation Tax within three months of starting to trade. A founder of a marketing agency I knew missed this cutoff and was immediately hit with a £100 penalty.

Ignoring this deadline doesn’t just cost you money; it can also damage your standing with HMRC.

- Find your incorporation date on your Certificate of Incorporation.

- Work out the date your business officially started trading.

- Register online with HMRC well before the three-month deadline passes.

Trust me, registering late isn’t worth the risk. It can trigger both penalties and unwanted extra scrutiny from HMRC.

Not Double-Checking Submission Details

Rushing through your application and submitting forms with incomplete or incorrect details will bring the whole process to a grinding halt. One director I spoke to entered the wrong date of birth by a single digit and had to restart the entire application from scratch.

Hasty submissions are often littered with simple errors:

- Typos in addresses or the company name.

- Missing information for a director or shareholder.

- Incorrect figures in the statement of capital.

Bulletproof your application by slowly reviewing every single field. A simple pre-submission checklist can be a lifesaver here.

Overlooking Key Permissions and Roles

Some words can’t just be used in a company name without permission. If you want to use terms like “Academy,” “Bank,” or “Royal,” for example, you’ll trigger extra checks. A fitness startup had to go through the process of securing Home Office approval just to use the word “Academy” in its name.

Always check if any of your chosen words are on the sensitive list.

- Review the official Companies House guidance on restricted terms.

- Make sure you get any required letters of permission before you apply.

- Keep copies of all approvals safely with your company records.

Failing to Register for VAT When Required

As soon as your turnover hits the £90,000 threshold (as of April 2024) in a rolling 12-month period, you are legally required to register for VAT. Missing this deadline means you’ll be liable for all the VAT you should have collected, straight out of your own pocket.

A fashion boutique owner I know saw her sales top £95,000 but didn’t register for another six months. HMRC hit her with a bill for all the VAT she should have charged during that period, plus interest and a penalty.

- Monitor your rolling 12-month turnover every month so you can see the threshold approaching.

- Register for VAT on GOV.UK within 30 days of crossing the limit.

- Keep clear, accurate sales records to avoid any nasty surprises.

Late VAT registration is a silent cashflow killer and can seriously damage your relationships with suppliers.

For more support on how to register a business, visit Grow My Acorn for essential checklists.

Armed with this advice, you can navigate the registration process confidently, avoid the common pitfalls, and get back to focusing on what really matters: growing your new venture.

Your Business Registration Questions Answered

Jumping into the world of business registration can feel like learning a new language. It’s completely normal to have questions swirling around about the costs, what address to use, and whether you need to bring in the pros.

To clear things up, I’ve put together some straightforward answers to the most common queries we get from new entrepreneurs. The goal here is to cut through the jargon and give you the clarity you need to move forward with confidence.

How Much Does It Cost To Register a Business in the UK?

The price tag for registering your business really comes down to the structure you choose. The great news for many is that one of the most popular routes won’t cost you a penny to set up officially.

If you’re going down the sole trader route, registering with HMRC is completely free. There are no government fees for letting them know you’re self-employed and will be filing a Self Assessment tax return.

For those setting up a limited company, the standard online fee with Companies House is currently £50. While the process is designed for you to do it yourself, many founders decide to use a company formation agent. These services might add a bit to the cost, but they handle the paperwork and often throw in perks like a registered office address, which can be a huge time-saver.

Save £35.00 on Company Registration Fees – Use our Company Name Availability Checker and you can form your company whilst opening a business bank account for just £15.00 including the £50.00 Companies House fee

Can I Use My Home Address To Register My Business?

Yes, you absolutely can, but it’s vital to think about the privacy side of things before you commit. When you register a limited company, your registered office address becomes public information. It’s listed on the Companies House register for anyone and everyone to see.

For example, if you live at 123 Oak Lane, that address will be publicly visible online. Because of this, many founders opt for a virtual office service to keep their home life private. It gives you a professional business address for all your official mail without putting your home on a public database.

For sole traders, using your home address is pretty standard and less of a public concern, as it isn’t displayed on a central register in the same way. Just remember, it will still be the official address for all your dealings with HMRC and your clients.

Using a virtual office address is a popular and affordable solution for limited company directors who want to maintain a clear line between their home and business life. It adds a layer of professionalism while safeguarding personal privacy. Checkout the Registered Office service from Acorn Business Solutions

Do I Need an Accountant To Register My Business?

You’re not legally required to hire an accountant to register your business. Many founders successfully handle the initial setup on their own, as the online processes for both sole traders and limited companies are pretty user-friendly.

However, bringing an accountant on board from day one can be one of the smartest moves you make. For instance, an accountant could advise a new IT contractor that a limited company offers better tax efficiency and liability protection than a sole trader setup, potentially saving them thousands in the long run.

A good accountant ensures all your filings with HMRC and Companies House are spot on from the get-go. Think of it as a small upfront investment that can save you from making costly mistakes down the line, giving you peace of mind and more time to focus on actually building your venture.

Ready to take the next step? For more expert guides and practical advice on starting and growing your venture, Grow My Acorn is your go-to resource. Visit us at https://growmyacorn.co.uk for the information you need to succeed.